As 2024 dawns on the UK savings market, we mark a quarter-century since ISAs were introduced by the then-Chancellor of the Exchequer, Gordon Brown, in 1999. The Individual Savings Account (ISA), originally designed to encourage the habit of saving with tax-free benefits, has evolved into a complex landscape scattered with numerous options. From cash to stocks and shares ISAs, to the more specific Help to Buy ISAs, Lifetime ISAs, and Junior ISAs, the market today is a testament to the ever-adapting nature of financial services to meet a growing array of consumer needs.

Today the ISA marketplace is more competitive than ever, and customers are spoilt for choice – but with more choice comes the daunting task of navigation. In an age where a Google search can leave you more confused than when you started, just how do you find your way through the crowded waters of the ISA market?

Let's take a step back to understand the ISA. The introduction of ISAs was a pivotal moment in personal finance. It simplified the saving landscape, merging the tax-free privileges of PEPs (Personal Equity Plans - remember those?) and TESSAs (Tax-Exempt Special Savings Accounts) into a single, more accessible product. With the promise of tax-free savings and a wide variety of investment options, ISAs felt much simpler and were instantly appealing.

For years, however, the yields on these products were unimpressive. Institutions tiptoed around the actual number in their advertising, as rates like 1.87% were not exactly cause for celebration, especially when they lagged behind inflation. Fast forward to today, and the scenario is massively different. The average ISA rate has leapfrogged to around 4%, spurring consumers and providers alike into action.

The ripple effect of rising interest rates has seen the UK deposit market flourish, attracting numerous new and diverse players. Traditional brick-and-mortar institutions now vie with sleek, digital-first banks for a share of the savers’ pie. Monzo and Zopa, with their intuitive app-based platforms, offer savers the convenience and competitive rates they crave. Investment giants like AJ Bell and Hargreaves Lansdown, traditionally known for their stocks and shares ISAs, have also stepped into the realm of cash ISAs.

The established high street banks and building societies, with their enduring presence, occupy an important place in this landscape. They are poised to offer that crucial blend of help and advice for customers feeling adrift in a sea of options.

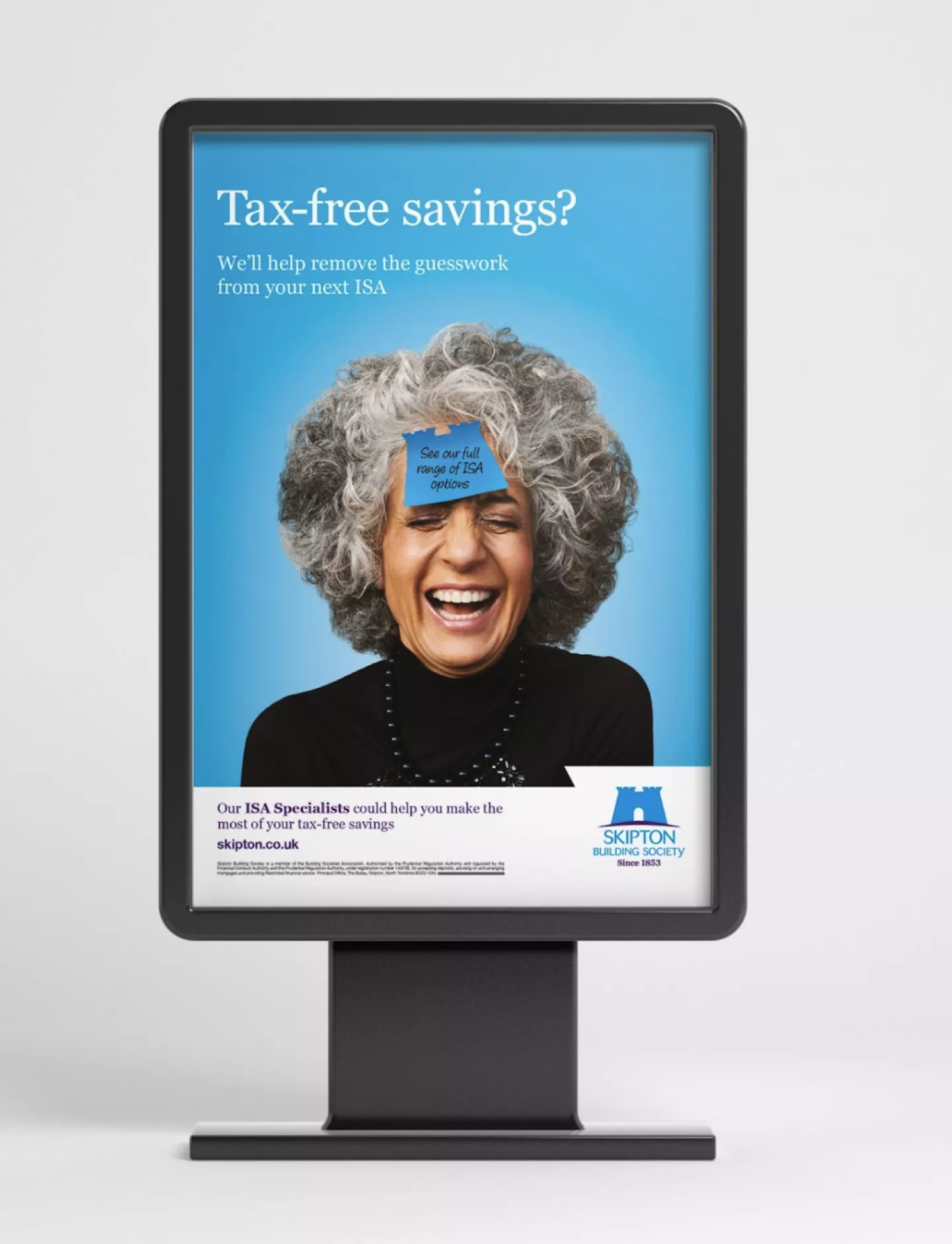

Creode helped Skipton Building Society bring this message to life in their 2022 ISA campaign which focussed on helping customers 'remove the guesswork’ when choosing their next ISA.

As every ISA provider beckons with open arms, the sheer volume of choices can be overwhelming. For savers, it can often feel like navigating a dense fog – knowing what you want is one thing, but how to get there is quite another.

Here's how consumers might begin to wade through the wealth of options:

Understanding the Varieties

Cash ISAs: Perfect for the risk-averse saver, these ISAs promise fixed returns and are an excellent choice for emergency funds or short-term goals.

Stocks and Shares ISAs: Suitable for the long-term saver who is willing to weather market fluctuations for potentially higher returns, these are great for retirement savings or significant future expenditures.

Help to Buy ISAs: Aimed at prospective homebuyers, these accounts offer government bonuses on savings used towards purchasing a first home.

Lifetime ISAs: A boon for the under-40s, this ISA serves dual purposes, aiding those saving for retirement or a first home with attractive government contributions.

Junior ISAs: Designed to secure a child's financial future, these accounts empower parents to save for their children, tax-free, until they come of age.

Assessing Your Needs

Savers should consider their financial goals as the primary navigational aid. The immediate need for funds will see easy-access Cash ISAs as the go-to, whereas long-term goals might align more with the growth potential of stocks and shares ISAs.

Choosing Your Provider

Digital Banks: For tech-savvy individuals who value a seamless digital experience and competitive rates, digital banks might be their port of call.

Investment Platforms: Those leaning towards stocks and shares and who appreciate robust investment interfaces, research tools, and a broad market view will find a home with platforms like AJ Bell or Hargreaves Lansdown.

Traditional Banks and Building Societies: For savers who seek the reassurance of established institutions and value face-to-face interactions, the high street can still offer competitive products along with the personal touch.

Every ISA Provider Wants You: Making Your Choice

In 2024, as you ponder where to cast your financial net, remember that every ISA provider is vying for your attention. The key is not to be swept away by the current but to chart your course based on informed decisions that align with your personal financial map.

Research is paramount, as is regularly checking your current ISAs to ensure they remain competitive. In an era of high choice, it's more important than ever to stay informed and agile, ready to shift your savings to where they'll work hardest for you.

As we weigh anchor on this journey through the ISA market of 2024, let's not be daunted by the wealth of choices. Instead, let's view it as an opportunity – to find the perfect financial vessel tailored to our unique journey towards achieving our monetary goals. With a sturdy ship and a sound navigation plan, we're set to sail toward a more prosperous horizon.