We love creating engaging online tools for financial service providers. See how we did it for one of the UK's largest building societies.

Currently 12.7 million adults are in the financial advice gap. 49% of savers have low confidence in investment products. With in-house expert financial advisers, Skipton Building Society has a robust FA offer, but not one that, on first impression, seems readily available—or appropriate—for a large proportion of the audience.

The aim was to grow the Financial Advice customer base by targeting the pre-retired mass affluent - ABC1’s aged 40-65.

However, by analysing Skipton’s existing customers and working with Experian, we identified the core audience for this campaign was actually those higher income households where the average age was 41-55.

This group have younger families and are time poor. Our insight showed that a large proportion of our audience saw the words, ‘Financial Advice’ and thought that, because they perceived it to be for more affluent people, it didn’t relate to them.

In the above insight, we saw opportunities to convince the audience this service was for them—both through the messaging and through the medium and channels. We developed ways we could speak to the initial target audience, whilst also taking advantage of the Experian data in order to make our activity exceed the business objectives.

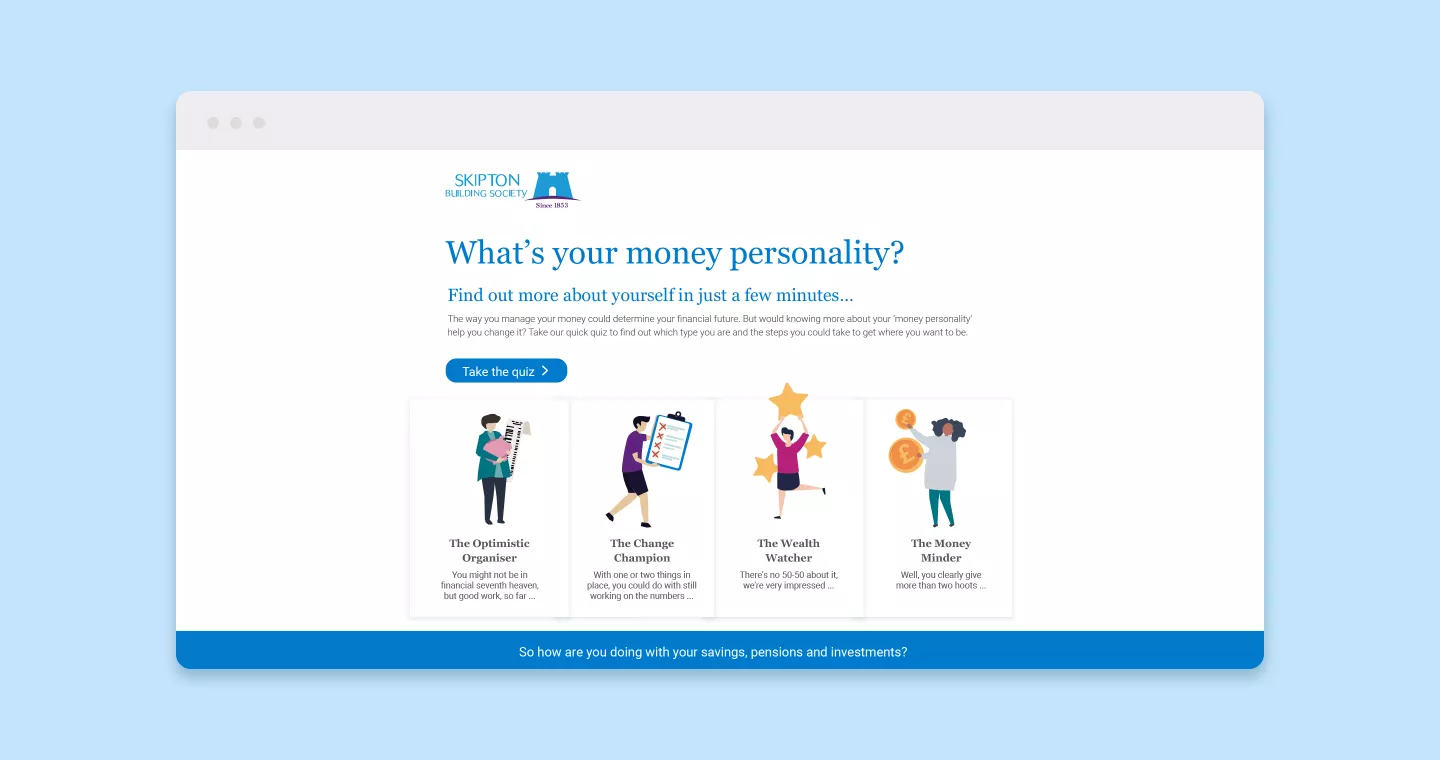

In terms of talking points, we identified a number of triggers or events that might make them take that first step to find out about investment or retirement planning; the birth of a child, a new house purchase, change of job, receiving inheritance, children going to university or paying off student loans. The strategy was to ‘trigger’ some real thinking around those lifestyle forks in the road, by asking personal questions of the customer and by using gamification. This was our way to get people into the funnel, whilst showing characters that reflected them and their circumstances. There was already heavy use of the format on platforms like Facebook and we levered the human truth, highlighted on social media, that people are very interested in themselves.

For our audience, life is pretty hectic; balancing busy careers, working from home whilst coping with the pressures of family life. Thinking about the state of their longer term finances, or what your retirement might look like might feel like a scary and complicated subject, and one that they felt they could deal with later down the line.

So we simplified their perceived personal situations and helped people make sense of their own circumstances, by asking them questions about their life now and the life they might want in the future, within the context of a ‘what next?’ quiz game.

As part of Creode’s mantra of continuous improvement, we have updated this tool several times in terms of UX, copy and online targeting to achieve over and above the original target.